Chainlink (LINK)

Our Prediction for Chainlink Price 2024-2030

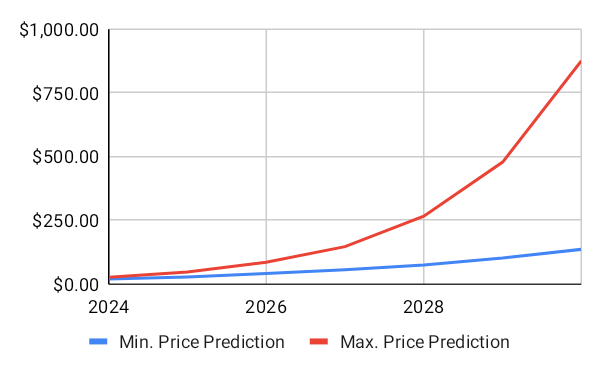

To assist you in estimating the profits, we provide a thorough guide with price projections for Chainlink from 2024 to 2030. According to our analysts’ Chainlink price prediction, the highest price LINK will reach by 2030 is $875.68.

What is LINK Crypto?

Chainlink, or LINK, is like a link between blockchains and real-life info. SmartContract Chainlink Limited made it to help smart contracts use data from outside without worries. It grabs stuff from APIs and regular finance setups. Chainlink’s goal? Serve up reliable data so blockchain apps can flex their muscles and adapt better.

Key Features of Chainlink

- Decentralization: Chainlink functions as a network of decentralized oracles. It gathers data from several nodes dispersed around the network.

- Oracle Network: Chainlink serves as a conduit for real-world data and blockchain smart contracts.

- Security: Chainlink makes use of a number of security techniques, such as cryptographic proofs, multiple oracles, and data aggregation. This improves the security of decentralized apps (dApps) that depend on outside data sources.

- Flexibility and Customization: A plethora of customization possibilities are available to developers. Chainlink enables the integration of particular data sources and the construction of unique Oracle networks.

- Cross-Chain Compatibility: Chainlink’s infrastructure is designed to be interoperable across multiple blockchains. This allows smart contracts on different networks to access the same reliable data feeds.

Partnerships and Adoption

By teaming up with big players like Swift, Chainlink ensures payment info is safe and timely. Also, by working with PayPal and Visa, it’s getting even stronger in making payments work better. People looking at where Chainlink might go with its price also keep an eye on these moves.

Chainlink (LINK) Adoption and Technology

Chainlink Adoption

Chainlink is a de facto of some industries and markets. Its widespread adoption demonstrates the versatility of Chainlink’s oracle technology across different sectors. The token’s scale of adoption directly affects how we work out our Chainlink Price Prediction models.

- Decentralized Finance (DeFi): Chainlink provides a decentralized Oracle solution, ensuring reliable data feeds.

- Gaming and Non-Fungible Tokens (NFTs): Some games integrate Chainlink’s Oracle solutions for obtaining real-time data within games.

- Insurance and Risk Management: The token’s decentralized oracles help insurance companies access external data securely.

Chainlink Technology

These parts make up the core of Chainlink’s tech. They help move data safely from outside to inside the blockchain’s smart contracts. This makes blockchain apps do more things and affects Chainlink price prediction.

- Oracle Nodes: Oracle nodes retrieve external data from various off-chain sources.

- Decentralized Oracle Networks (DON): Chainlink uses a decentralized network of Oracle nodes known as Decentralized Oracle Networks (DON).

- Data Aggregation: Chainlink facilitates data aggregation from multiple sources.

- External Adapter: External adapters in Chainlink enable connectivity to various external systems and APIs.

- Service-Level Agreements (SLAs): Chainlink introduces Service-Level Agreements (SLAs) to ensure Oracle node reliability and performance.

- Token (LINK): LINK is the native cryptocurrency of the Chainlink network. It serves as a utility token used for various purposes within the ecosystem.

Challenges and Controversies

Chainlink faced several challenges and controversies. One prominent issue involved security concerns, as some decentralized applications (DApps) using Chainlink’s Oracle services encountered vulnerabilities. Additionally, critics highlighted potential centralization risks due to reliance on a limited number of node operators. Such challenges raised debates about Chainlink’s decentralization and security measures.

LINK Technical Analysis

Analysts rely on a wide range of dependable tools to build a model for Chainlink price prediction. Here’s a breakdown:

- Price Trends and Patterns: Traders use price charts to identify trends and patterns in LINK’s price movements. These may include ascending or descending trends, support and resistance levels, chart patterns, and trend reversals.

- Moving Averages (MA): Moving averages, such as the 50-day or 200-day moving average, help traders assess the average price of LINK over specific periods.

- Relative Strength Index (RSI): The RSI measures the speed and change of price movements. Traders consider RSI levels to assess if LINK is potentially overvalued or undervalued. A reversal, for instance, negatively impacts our Chainlink Price Prediction models.

- Volume Analysis: Trading volume is analyzed to confirm price movements. An increase in volume often supports the significance of a price change and positively impacts our Chainlink Price Prediction models.

- Moving Average Convergence Divergence (MACD): The MACD indicator shows the relationship between two moving averages.

- Fibonacci Retracement Levels: Fibonacci retracement levels help traders identify potential support and resistance levels based on key percentages (e.g., 23.6%, 38.2%, 61.8%) drawn from significant price movements.

- Volume Weighted Average Price (VWAP): VWAP calculates the average price weighted by trading volume over a specific period. Traders assess if the current price is above or below the VWAP, which might indicate the current trend’s strength and positively impact our Chainlink price prediction model.

- Bollinger Bands: They consist of three lines that indicate potential price volatility and overbought or oversold conditions

LINK Price Predictions: 2024-2030

Conducting a Chainlink price prediction accurately remains a complex task in the volatile cryptocurrency markets.

- Market Sentiment: Positive news, developments, or sentiment towards the project can drive Chainlink price prediction up. Negative sentiment or market fear can in contrast push prices down.

- Adoption and Integration: This Chainlink price prediction may benefit from a greater number of decentralized apps (DApps) and organizations utilizing its Oracle services.

- Technology and Development Updates: New improvements of the decentralized Oracle network can pique investor interest and help our Chainlink price prediction to improve.

- Market Volatility and Speculation: The Chainlink price prediction may be unexpectedly impacted by changes in trading volumes and speculative trading.

- Partnerships and Collaborations: Positive Chainlink price prediction movements may result from the announcement of high-profile partnerships or integrations with well-known platforms.

- Regulatory Environment: Uncertainty about the current status of rules can lead to price swings due to market reactions, which can then affect our Chainlink price prediction models.

- Token Economics and Supply Dynamics: Shifts in these areas may have an effect on how investors view scarcity and utility. Unavoidably, this will have an impact on our Chainlink price prediction models.

- Macroeconomic Factors: Changes in the market as a result of macroeconomic factors may have an effect on how investors behave concerning cryptocurrencies. Our Chainlink price prediction study will be included in this as well.

| Year | Min. Chainlink Price Prediction | Max. Chainlink Price Prediction |

| 2024 | $19.70 | $26.58 |

| 2025 | $27.66 | $47.44 |

| 2026 | $41.17 | $85.26 |

| 2027 | $55.85 | $146.68 |

| 2028 | $74.61 | $265.94 |

| 2029 | $101.88 | $478.32 |

| 2030 | $136.12 | $875.68 |

LINK Price Prediction 2024

Chainlink price prediction and historical pricing data indicate that the average trading price of the LINK coin is projected to be $34.98. The current Chainlink price prediction is the LINK to range from $15.08 at the lowest to $26.58 at the maximum.

| Month | Min. LINK Price Prediction | Max. LINK Price Prediction |

| January | $15.08 | $15.25 |

| February | $15.08 | $15.98 |

| March | $15.83 | $16.91 |

| April | $16.01 | $17.43 |

| May | $16.34 | $18.34 |

| June | $16.93 | $19.15 |

| July | $17.56 | $20.23 |

| August | $18.26 | $21.24 |

| September | $18.49 | $22.51 |

| October | $19.06 | $23.84 |

| November | $19.34 | $25.00 |

| December | $19.70 | $26.58 |

| Price Average | $34.98 | $20.20 |

LINK Price Prediction 2025

Our Chainlink price predictions based on past trends indicate that the average trading price of the LINK coin is projected to be $50.30 by 2025. The Chainlink price prediction is that LINK is expected to range from $28.22 at the lowest to $85.26 at the maximum.

| Month | Min. LINK Price Prediction | Max. LINK Price Prediction |

| January | $28.22 | $49.67 |

| February | $29.28 | $51.34 |

| March | $30.71 | $54.23 |

| April | $32.08 | $57.07 |

| May | $33.32 | $60.65 |

| June | $34.68 | $63.92 |

| July | $35.70 | $67.60 |

| August | $36.83 | $70.15 |

| September | $36.90 | $74.05 |

| October | $38.53 | $77.91 |

| November | $39.44 | $81.82 |

| December | $41.17 | $85.26 |

| Price Average | $28.74 | $50.30 |

LINK Price Prediction 2026

Chainlink price prediction for 2024 estimates that the LINK market could climb as high as $0.18 and floor at $0.11. Our technical analysis suggests that the average price throughout 2024 could be $0.21.

| Month | Min. LINK Price Prediction | Max. LINK Price Prediction |

| January | $28.22 | $49.67 |

| February | $29.28 | $51.34 |

| March | $30.71 | $54.23 |

| April | $32.08 | $57.07 |

| May | $33.32 | $60.65 |

| June | $34.68 | $63.92 |

| July | $35.70 | $67.60 |

| August | $36.83 | $70.15 |

| September | $36.90 | $74.05 |

| October | $38.53 | $77.91 |

| November | $39.44 | $81.82 |

| December | $41.17 | $85.26 |

| Price Average | $28.74 | $50.30 |

LINK Price Prediction 2027

Chainlink price prediction for 2024 estimates that the LINK market could climb as high as $0.18 and floor at $0.11. Our technical analysis suggests that the average price throughout 2024 could be $0.21.

| Month | Min. LINK Price Prediction | Max. LINK Price Prediction |

| January | $41.64 | $90.02 |

| February | $41.78 | $93.64 |

| March | $43.79 | $98.43 |

| April | $45.07 | $102.26 |

| May | $46.79 | $108.28 |

| June | $47.48 | $113.79 |

| July | $48.96 | $118.54 |

| August | $51.06 | $123.44 |

| September | $52.64 | $130.07 |

| October | $53.06 | $133.99 |

| November | $53.22 | $138.88 |

| December | $55.85 | $146.68 |

| Price Average | $41.08 | $89.68 |

LINK Price Prediction 2028

Our 2028 Chainlink price prediction indicates that the currency will fluctuate between $56.81 and $265.94. Additionally, our price projections point to an average price of $56.22.

| Month | Min. LINK Price Prediction | Max. LINK Price Prediction |

| January | $56.81 | $153.31 |

| February | $58.96 | $160.32 |

| March | $60.87 | $170.45 |

| April | $63.29 | $179.21 |

| May | $63.46 | $185.68 |

| June | $64.19 | $194.08 |

| July | $65.08 | $205.16 |

| August | $65.91 | $219.11 |

| September | $68.77 | $230.96 |

| October | $69.79 | $244.77 |

| November | $71.40 | $256.48 |

| December | $74.61 | $265.94 |

| Price Average | $56.22 | $158.13 |

LINK Price Prediction 2029

Based on historical pricing data and Chainlink forecasts, the LINK token is expected to trade for $75.82 on average. It is forecast that the lowest Chainlink price prediction will be $77.03, and the highest price will be $478.32.

| Month | Min. LINK Price Prediction | Max. LINK Price Prediction |

| January | $77.03 | $274.00 |

| February | $80.39 | $284.79 |

| March | $81.46 | $299.06 |

| April | $82.27 | $318.02 |

| May | $84.48 | $331.44 |

| June | $85.47 | $344.14 |

| July | $88.09 | $362.24 |

| August | $90.55 | $381.22 |

| September | $91.67 | $401.32 |

| October | $94.42 | $421.76 |

| November | $98.50 | $448.62 |

| December | $101.88 | $478.32 |

| Price Average | $75.82 | $278.48 |

LINK Price Prediction 2030

The 2030 LINK price estimate suggests that the minimum price of Chainlink could be $106. By 2030, the average transaction price of Chainlink is expected to reach $103.28. Furthermore, there’s a Chainlink price prediction of it being top at $875.68.

| Month | Min. LINK Price Prediction | Max. LINK Price Prediction |

| January | $106.31 | $511.23 |

| February | $110.48 | $545.07 |

| March | $112.71 | $573.36 |

| April | $112.91 | $607.19 |

| May | $116.40 | $638.64 |

| June | $117.66 | $674.47 |

| July | $119.30 | $697.54 |

| August | $124.76 | $724.39 |

| September | $128.54 | $762.28 |

| October | $129.46 | $792.24 |

| November | $135.32 | $835.73 |

| December | $136.12 | $875.68 |

| Price Average | $103.28 | $514.19 |

LINK Price Prediction: Expert Opinion

Nicholas Merten: The well-known cryptocurrency expert and DataDash founder Nicholas Merten has high hopes for Chainlink price prediction. He thinks that Chainlink’s value may rise steadily due to its continuing use in a variety of applications and its standing as a trustworthy and well-established cryptocurrency.

PlanB: Well-known for its “Stock-to-Flow” model, which forecasts the price of Bitcoin, the company hasn’t made any official Chainlink price prediction. But given the model’s emphasis on value and scarcity, it’s plausible that PlanB views Chainlink’s restricted supply and continuing uptake as elements that might favourably affect its price trajectory in the future.

Willy Woo: Willy Woo has a sizable Twitter following; thus, his perspective on Chainlink price prediction topic may highlight LINK’s adoption patterns. In order to determine Chainlink’s growth potential, he might evaluate its core advantages and technological advancements.

The Group Chainlink: The Chainlink Team may view Chainlink as one of the many cryptocurrencies available in the market despite its primary focus being on its blockchain oracle network. Their Chainlink price prediction might draw attention to more general business trends, advancements, and possible alliances that might have an unintended effect on Chainlink’s future worth.

LINK: A Conclusive Force

As a bridge between blockchain technology and real-world data, Chainlink sometimes referred to as LINK, ensures that smart contracts operate safely and cooperatively. It all comes down to strength and confidence, giving reliable data to applications across many industries. Chainlink’s several nodes work with one another, verifying and gathering data from various sources instead of depending on a single boss. These nodes, referred to as oracles, avoid any pitfalls or errors.

Chainlink’s magic? Its robust Oracle network securely intercepts external data from devices like IoT devices or APIs, guaranteeing that smart contracts process accurate data. They employ sophisticated data verification and agreement techniques to maintain the data reliability.

Plus, Chainlink is flexible and friendly. It tailors solutions for different jobs, spreading across blockchains and letting contracts chat smoothly between different networks. Picture this impact: in finance (DeFi), Chainlink keeps data secure for loans, farming, and exchanges. Even in supply chains, it’s a game-changer, making things transparent and trustworthy with real-time data links.